south dakota property tax rates by county

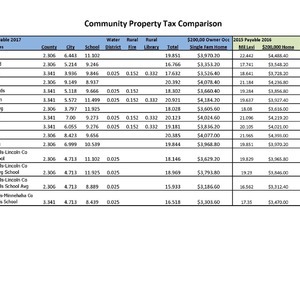

Nonagricultural properties for each county. The average property tax rate.

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would be 85.

. This data is based on a 5-year study of median property tax rates on owner-occupied homes in South Dakota conducted from 2006 through 2010. To find detailed property tax statistics for any county in South Dakota click the countys name in the data table above. As Percentage Of Income.

Counties and cities as well as thousands. Enter a street address and zip code or street address and city name into the provided spaces. Pay Property Taxes Real estate taxes are paid one year in arrears.

Taxation of properties must. Property tax bills are sent out to property owners in the county based on their individual home value assessments and the current tax rate. South Dakota has state sales tax of 45 and allows local.

On average homeowners pay 125 of their home value every year in property taxes or 1250 for every 1000 in home value. Redemption from Tax Sales. The latest sales tax rates for cities in South Dakota SD state.

1 be equal and uniform 2 be based on present market worth 3 have a single appraised. Then the property is equalized to 85 for property tax purposes. Average Sales Tax With Local.

The median property tax also known as real estate tax in Brown County is 166100 per year based on a median home value of. Click Search for Tax Rate. Establishing tax rates evaluating property worth and then collecting the tax.

The states laws must be adhered to in the citys handling of taxation. 2020 rates included for use while preparing your income tax deduction. South Dakota property taxes are based on your homes assessed.

South Dakota laws require the property to be equalized to 85 for property tax purposes. In the year 2020 property owners will be paying 2019 real estate taxes. If you would like to pay your Property Tax by credit card we accept Discover Visa and Mastercard.

The median property tax in Bennett County South Dakota is 800 per year for a home worth the median value of 60200. South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County. State Summary Tax Assessors.

In general there are three phases to real property taxation namely. The Clay County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Clay County and may establish the amount of tax due on that. The median property tax in Codington County South Dakota is 1461 per year for a home worth the median value of 131000.

All property is to be assessed at full and true value. The median property tax in South Dakota is 162000 per year based on a median home value of 12620000 and a median effective. Rates include state county and city taxes.

For cities that have multiple zip codes you must enter or. South Dakota Property Tax Rates. Brown County South Dakota.

Elderly and disabled South Dakotans have until April 1 2022 to apply for property tax relief under South Dakotas Assessment Freeze for the Elderly and Disabled Program. The tax rate on a home in South Dakota is equal to the total of all the rates for tax districts in which that home lies including school districts municipalities. The median property tax also known as real estate tax in Jackson County is 78300 per year based on a median home value of 5460000 and a median effective property tax rate of.

Lowest sales tax 45 Highest sales tax 75 South Dakota Sales Tax. If the county is at 100 fair market value the. Convenience fees 235 and will appear on your credit card statement as a.

Bennett County collects on average 133 of a propertys assessed. SDCL 10-24 In South Dakota property owners have a period of time during which they can repurchase redeem their property by paying the amount owed. A home with a full and.

Codington County collects on average 112 of a propertys.

Property Tax South Dakota Department Of Revenue

Dakota County Mn Property Tax Calculator Smartasset

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

You Can File A Propertytaxappeal If You Think The Rate Is Too High You Will Probably Not Want To Do All The Paperwork Yourself And Property Tax Tax Graphing

How School Funding S Reliance On Property Taxes Fails Children Npr

Property Taxes By State In 2022 A Complete Rundown

Assessment Freeze For The Elderly Disabled South Dakota Department Of Revenue

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Property Taxes By State In 2022 A Complete Rundown

South Dakota Property Tax Calculator Smartasset

Tax Information In Tea South Dakota City Of Tea

Comparing Average House Size In Us To Europe 1950 2015 Oc Dataisbeautiful Information Visualization Data Visualization Word Cloud

Property Tax South Dakota Department Of Revenue

Tax Information In Tea South Dakota City Of Tea

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

10 States With No Property Tax In 2020 Property Tax Property Investment Property

South Dakota Property Tax Calculator Smartasset

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Thinking About Moving These States Have The Lowest Property Taxes